georgia film tax credit requirements

The credit is transferable and. The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability.

Sean Brian Creator Founder High Box Office Movies Distribution Re Releasing Movies And Tv Series Globally For More Infor Reality Tv Hollywood Celebrities

Start Your Tax Return Today.

. Certification for live action projects will be through the Georgia Film Office. Georgia Film Tax Credit Audit Procedures Manual May 11 2022 Page 2 Projects certified by GDEcD on or after January 1 2022 to a production company if such tax credit sought for the project exceeds 125 million. In order to qualify individuals or corporations need to have.

A Project Certification Requirement. The Georgia Department of Revenue GDOR offers a voluntary program. The base credit rate was raised to 20 in 2008 with an additional 10 for a qualified promotion of the state eg Georgia logo.

Working with the BJM team you decide to purchase 100000 of Georgia tax credits over 3 years. Taxpayers have the ability to purchase these credits retroactively for up to three years. Free means free and IRS e-file is included.

Note if other services are rendered by the provider the normal rules would still apply. The audit is requested through the Georgia Department of Revenue website GDOR and. 159-1-1-05 Qualified Productions Production Activities.

Georgia Issues Film Tax Credit Guidance Addressing Georgia Vendor Requirements April 27 2018 Production companies in Georgia who purchase or rent property from vendors located in Georgia may not be able to get film tax credits for the cost of obtaining that property if the vendor is really a conduit. A final tax certification is not required before January 1 2023 for. Money to buy the credits.

For the rental of Georgia real property or property that is affixed to such property such as a stage the vendor does not have to meet the Georgia vendor requirements. A Base Certification Application may be submitted within 90 days of the start of principal photography. 159-1-1-01 Available Tax Credits for Film Video or Interactive Entertainment Production.

On average 1 of Georgia Film Tax credit can be purchased for 087 to 090. The verification reviews will be done on a first comefirst serve basis. The vendor is Georgia company with an office one regular employee and some.

Prior to claiming any Film Tax Credit each new film video television or Interactive Entertainment project must be certified as meeting the guidelines and the intent of the Act. Lets say that you paid at least 100000 in Georgia taxes over the past 3 years 2016-2018. 159-1-1-03 Film Tax Credit Certification.

Georgia Department of Revenue. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. TABLE OF CONTENTS.

Audits are required for Film Tax Credits based on the date the production was certified by the Department of Economic Development DECD and the amount of credit. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns. 1 State Certified Production.

FILM TAX CREDIT. About the Film Tax Credit First passed in 2005 Georgias film tax credit provides an income tax credit to production companies that spend at least 500000 on qualified productions. Ad All Major Tax Situations Are Supported for Free.

Heres a Georgia film tax credit example. Learn about the changes to the Georgia Film Tax Credit scheduled to go into effect in 2021 and new requirements including an independent audit - Atlanta CPA. 159-1-1-03 Film Tax Credit Certification.

1800 Century Blvd NE Suite 18104Atlanta Georgia 30345. Max refund is guaranteed and 100 accurate. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600.

All productions with credit more than 125000000. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. On March 7 2018 the Georgia Department of Revenue Department released Letter Ruling LR IT-2017-02 the ruling is dated May 17 2017 in which it addressed whether a vendor qualified as a Georgia vendor or a conduit pursuant to the facts summarized below.

159-1-1-04 Base Tax Credit Certification Application Process. Purposes of the Film Tax Credit. Unused credits carryover for five years.

A Base Certification Application may be submitted within 90 days of the start of principal photography. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. There is a tiered system that is based on the estimated tax credit value.

Certification for live action projects will be through the Georgia Film Office. All productions with credit more than 250000000. Click to learn additional information and to obtain the GDORs application form.

B Georgia Real Property Exception. Direct contact for an audit inquiry.

Eue Screen Gems Film Movie Production Complex In Atlanta Ga Atlanta Hotels Sound Stage Downtown Hotels

New Georgia Project On Instagram Reminder You Have The Legal Right To Create A Record Of Police Interactions Inspired By Impact

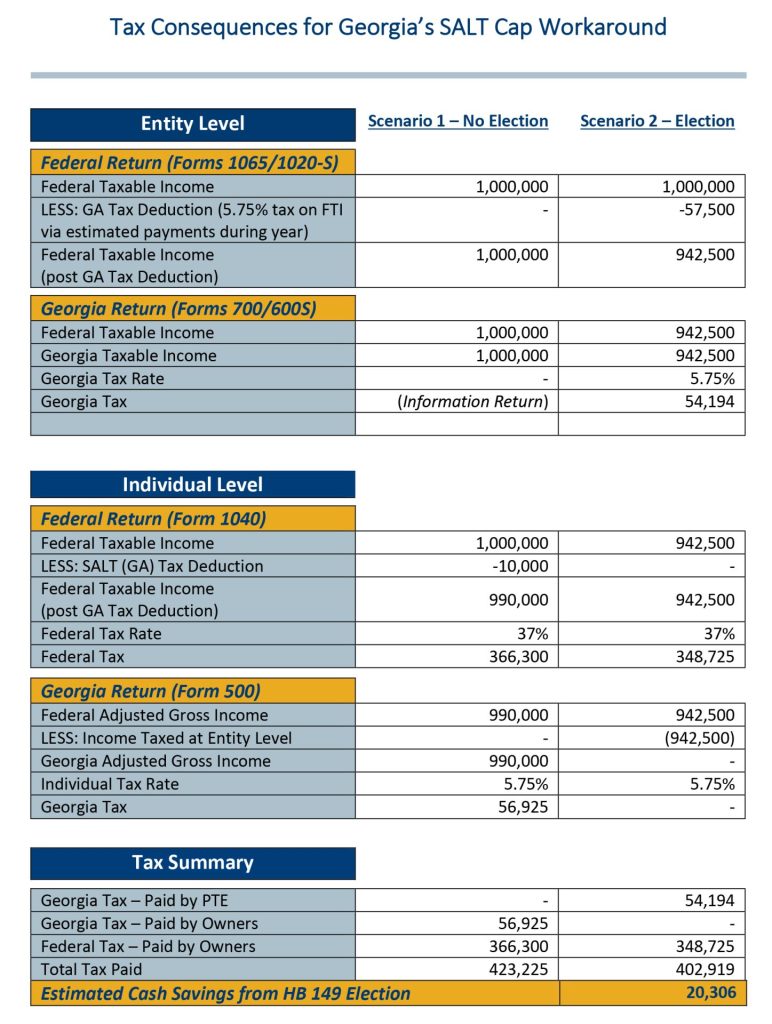

The Benefits Of Georgia S Salt Cap Workaround Bennett Thrasher

Celebrating The Economic Impact Of Productions In Georgia

Nlc Is Seeking People To Work In The Canton Ga Area Tomorrow Tuesday June 19 It Cast Life Cast Casting Call

Distributorship Of Transparent Tape Stretch Films

Georgia Film And Tv Productions Spent Record 4 4 Billion In Fiscal 2022

Industry S Most Competitive Incentives Lure Top Production Companies To Georgia Georgia Department Of Economic Development